200db depreciation calculator

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. This will in the 2018 tax year deduct depreciation expense as if the asset was put in service November 15 the middle of the last quarter of the year.

How To Calculate Macrs Depreciation When Why

Above is the best source of help for the tax code.

. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. The default in TurboTax is set to the 200DB depreciation method with a mid-quarter convention which is perfect for your circumstances. MACRS Depreciation Calculator Help.

How To Use The Excel Db Function Exceljet

Depreciation Macrs Youtube

How To Use The Excel Ddb Function Exceljet

Macrs Depreciation Calculator Straight Line Double Declining

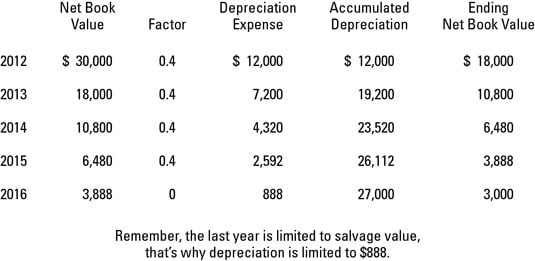

Double Declining Depreciation Calculator Efinancemanagement

Depreciation Schedule Template For Straight Line And Declining Balance

Double Declining Depreciation Calculator 100 Free Calculators Io

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Methods Dummies

Double Declining Balance Calculator For Depreciating Assets

Double Declining Balance Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

The Mathematics Of Macrs Depreciation

Macrs Depreciation Calculator Irs Publication 946

Lesson 7 Video 5 Declining Balance Switching To Straight Line Depreciation Method Youtube

Appliance Depreciation Calculator

2